- Clear rules will unlock crypto innovation in the U.S.

- Michael Saylor is urging lawmakers to define digital assets now.

- The upcoming Clarity Act of 2025 could shape the future of crypto regulation.

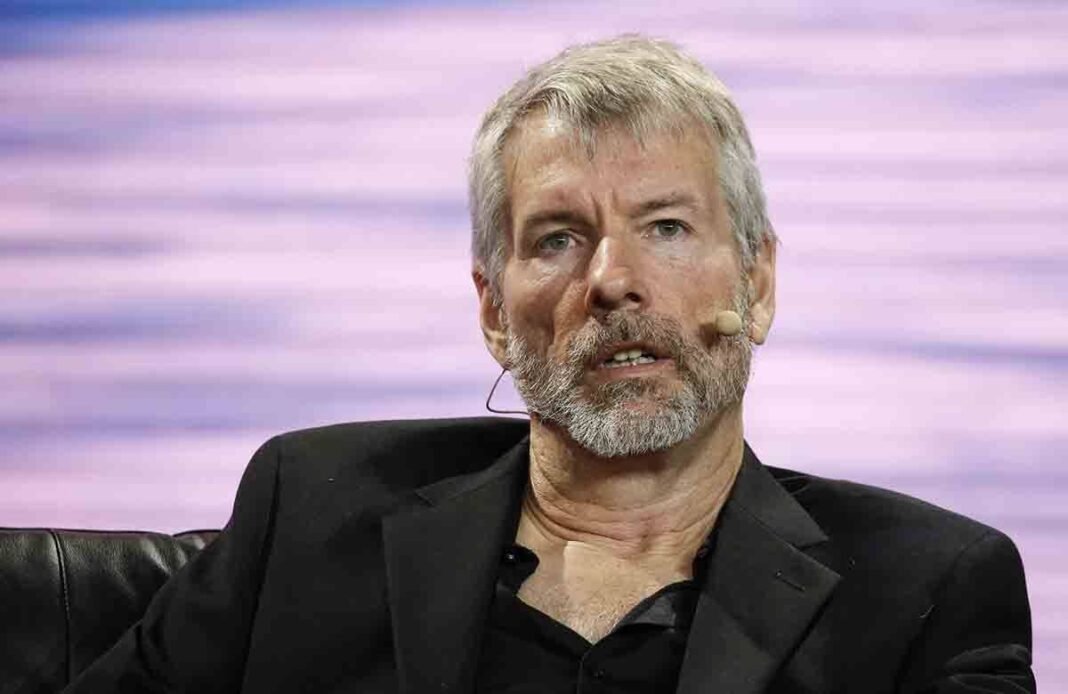

As the United States works to establish a legal framework for cryptocurrencies, MicroStrategy’s Executive Chairman, Michael Saylor, has stepped forward to call for clear definitions and stronger guidance. His remarks come at a time when the industry is growing rapidly but remains stuck in a web of regulatory uncertainty. Many believe that without clarity, the U.S. risks falling behind in the global race to lead the future of digital assets.

Why Legal Clarity Matters for Crypto

Cryptocurrencies have evolved from a niche innovation into a multitrillion-dollar market. Yet in the U.S., the lack of legal clarity continues to create problems for businesses, investors, and regulators. One of the biggest issues is how to classify different types of digital assets. Are they securities, commodities, or something else entirely? Without consistent rules, companies face compliance risks, and innovation often shifts overseas to jurisdictions with clearer policies.

Saylor argues that this uncertainty has reached a tipping point. On Strategy’s second-quarter earnings call, he explained that the U.S. must establish a crypto taxonomy that defines what qualifies as a digital security, what counts as a digital commodity, and under what conditions tokenization can occur. For businesses holding or issuing digital assets, the stakes are high. Without clarity, they risk regulatory action or costly legal battles.

The Government’s Efforts to Define Crypto

The timing of Saylor’s call is important. The White House Working Group on Digital Asset Markets has been pressing agencies like the SEC and CFTC to move faster in defining the legal boundaries of the crypto industry. Meanwhile, lawmakers are preparing to review the Digital Asset Market Clarity Act of 2025 this September. The bill aims to give formal definitions to digital securities, commodities, and issuer-less tokens, which could become the foundation of U.S. crypto regulation.

This effort follows years of conflicting statements and slow progress from regulators. The SEC, under Chairman Paul Atkins, has admitted that its cautious approach has allowed offshore markets to move ahead of the U.S. in areas like tokenized assets and decentralized finance. The push for a unified framework is seen as a critical step to ensure America remains competitive in the digital economy.

Saylor’s Role in the Crypto Conversation

Michael Saylor has long been one of the most influential voices in the crypto world. Through MicroStrategy—now rebranded as Strategy—he spearheaded one of the largest institutional investments in Bitcoin. But Saylor’s vision extends beyond holding Bitcoin. He believes that clear, enforceable rules will unlock the next wave of blockchain innovation, including tokenized securities, on-chain finance, and widespread adoption of decentralized technologies.

By joining the growing chorus of industry leaders calling for reform, Saylor is helping keep the pressure on policymakers. His message is that the U.S. cannot afford to delay any longer if it wants to remain at the center of the global crypto economy.

Industry Support for Reform

Saylor is far from alone in this push. Companies like Coinbase, Robinhood, and Fidelity have also urged the government to provide clearer rules. Their argument is simple: innovation thrives where rules are consistent and fair. Without them, projects and capital tend to move abroad, leaving the U.S. at risk of losing leadership in financial technology.

Many experts believe that once the Clarity Act and related measures pass, the floodgates will open for tokenization. Assets ranging from stocks and bonds to real estate and commodities could be represented on blockchain networks, making markets faster, more transparent, and more efficient.

Looking Ahead

The months ahead will be crucial. If the Clarity Act passes, it could mark the beginning of a new era for digital assets in the U.S. For now, the crypto industry is watching closely, hopeful that lawmakers and regulators will finally deliver the certainty they have been demanding for years.

Michael Saylor’s voice adds weight to the conversation, reminding policymakers that clarity is not just about regulation—it is about positioning the United States as a leader in the digital future.